The Impact on the Italian Aluminium Market

An estimate of the effects of the crisis due to Covid-19 on the aluminium market in Italy in 2020 according to company assessments

We hope that by the time this issue of A&L magazine will be published, the Covid-19 emergency will have progressively decreased in intensity, after having severely affected everyday life and the development of production chains, including aluminium. The inevitable lockdown imposed by the government has caused enormous damage and slowdowns to the entire economy in general, in the most critical period of the “quarantine” days we monitored our segment interviewing entrepreneurs and company managers to frame the situation and to understand possible future developments. We summarised the situation and derived the following report.

Which companies in the segment have restarted or never stopped their production?

Initially included among the activities considered strategic, as we promptly requested to national decision-makers, metallurgy in Italy was instead excluded at the last moment and only some sectors, mainly related to the production and distribution of laminates for the pharmaceutical industry, remained in business. Several companies have taken advantage of the possibility to operate in derogation of permitted ATECO codes, which in any case represent a very modest relative share. Many of the companies interviewed expressed the belief that the aluminium supply chain should in any case be considered essential and that the best part of the sector of metal production, foundries, extrusions, rolling, castings and die-castings production, downstream processing, could and should continue its activity. Office activities should have continued in smart working. In the building and construction segment, many questions were raised by the reopening of the production of PVC and wood doors and windows, while aluminium doors and windows were excluded. However, a large number of companies in the aluminium sector resumed production, possibly partially, in mid-April, obviously with all the necessary precautions for the safety of operators. Abroad, the situation has been interpreted differently with respect to Italy, so much so that many entrepreneurs have underlined the concept of asymmetric loss of competitiveness at European level and the strong risks of loss of positions on the market. During this monitoring of the sector, we received comments on the trend of the aluminium sector from other markets in the EU and other important macro areas, such as India, Russia, China, United States, Gulf countries, which we report elsewhere in the magazine; in general, it appears that few countries have adopted a complete lockdown of the entire aluminium production chain, probably due to a different contingent health situation.

What economic damage has the Covid-19 emergency caused to aluminium companies in the last few weeks of lockdown and what impact will all of this have on the performance of the industry in 2020?

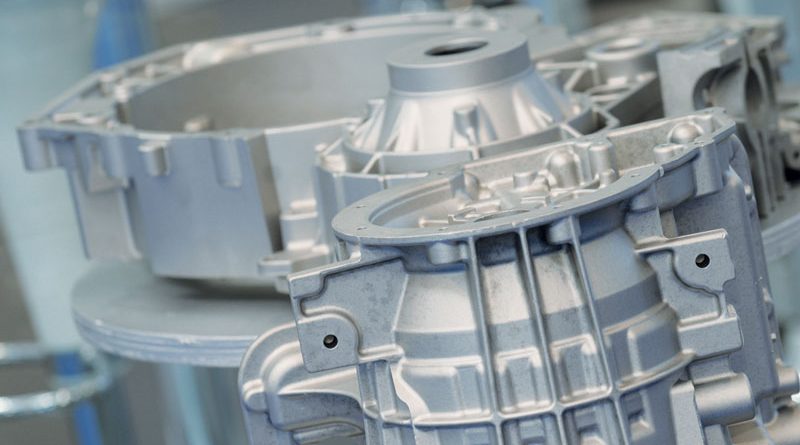

According to all those interviewed, the temporary lockdown of the Italian production chain in the industry has contributed and will contribute significantly to the economic results of the companies. The Covid-19 crisis has actually surpassed the sub-prime crisis in 2008, and it appears to be the worst since the end of the Second World War. Beyond the temporary production stoppage, what worries operators most is the fear of the repercussions on the market model and the uncertainty regarding the recovery in the demand of the automotive, building, aeronautical construction, and furniture sectors, just to name a few, without neglecting the devastating effects on some minor seasonal markets such as sea and leisure equipment, garden furniture, awnings and others. A significant drop in activity, up to over 50% in the period, was reported by surface treatment operators and casting manufacturers. Much concern has been expressed about the stop of investments which will lead to a long crisis for plant and machinery manufacturers. Many questions arise about the price of raw material, with prices collapsing below $1,500 per tonne for HG metal, which is unprofitable for many primary producers. However, reduced availability has led to higher scrap prices and as a result ingot manufacturers will have to raise their prices in order to survive. The fall in raw materials has heavily contributed to the devaluation of inventories and stocks, with an estimated decrease of around 20%; again in the absence of long-term contracts, which would lead to further losses in this situation. Other losses derive from the declared difficulty in collecting receivables, which also in this case vary according to the type of customer. The various financial instruments prepared by the government are appreciated, however, they will take time to provide adequate liquidity to the system and will not solve the economic problem of many companies requiring non-repayable grants and not only loans.

Is it possible to estimate the relative economic damage caused to your segment by the “asymmetric competition” between the measures taken in Italy and those adopted by other European countries on the closure of production activities?

The problem of the “asymmetric competition” resulting from the different provisions on closures in the various EU countries, has been perceived as having a strong impact, not so much for the immediate damage as for the possible repercussions on the market position in the medium-long term.

Undoubtedly, in the segment of products destined to export there has been a significant negative impact, not easily quantifiable and in any case variable from one company to another. The forced absence from the European market, even if limited to a period of time which may be estimated in weeks, and the simultaneous presence of competition, for some extrusion companies caused damage amounting to 10-15% of the production capacity, for the months of March and April; the negative impact for laminations was milder, while the effect for the production of foundry castings was much greater, also due to the drop in the automotive sector. For the coming months it will be a matter of making up for lost ground with investments and new commercial efforts.

A negative scenario aggravated by uncertainty during the recovery The current production stop imposed on aluminium production and processing by recent government restrictions will have a significant impact on Italian production and final consumption.

From our survey carried out during the period, we can reconstruct a first hypothesis on the aluminium market data referring to the end of 2020. Starting from the data of 2019, already slightly lower than the previous year, therefore from an overall Italian consumption of aluminium in all forms of just over 2 million tons, assuming a real loss of 30 calendar days of production from the typical total in February, we would already reach an overall reduction of more than 200 thousand tons for 2020. Even in the event of a rapid return to normality, this reduction could be reabsorbed only by imagining a full workload for the month of August, which is notoriously a period of production stoppage in Italy, a circumstance which today is to be considered very unlikely. Instead, a more negative picture should be taken into account, thinking of a possible drop in demand for aluminium in the second quarter, also due to the effect of a recovery slowed down after the crisis. The beginning of this year actually seemed quite promising, all the companies we interviewed declared encouraging workloads and orders at the beginning of the year, but the crisis in March, the consequent slowdown in all the typical sectors of aluminium production, unfortunately suggest a rather difficult recovery scenario. The sectors that should be most affected by this situation are die-casting, penalized by the drop in automotive and extrusion. Aluminium rolling, a strategic production for the pharmaceutical sector, should on the other hand be less affected by the negative phase. In our opinion, the result of 2020 could bring the data of the Italian aluminium system back by at least 10 years. Actually, we foresee that, due to the multiple effects and repercussions of this crisis, the final result of consumption could be between 1.5 and 1.6 million tons and this might still be quite optimistic. The situation throughout Europe should, more or less, reflect the Italian trend. Globally, the overall aluminium production value chain represents about 1% of global GDP, or about 800 billion dollars; declining global economic growth, declining consumption, a very low LME price and very low premiums are leading to production cuts, something that has already happened in China, for instance. A simple mathematical calculation leads to an overall global reduction, estimated at around 5%, provided the pandemic ends soon.