A European Industrial Policy for the Aluminium Sector

The entire European aluminium supply chain needs different and specific policies to support primary and downstream production. To overcome the ineffective system of import tariffs on primary metal

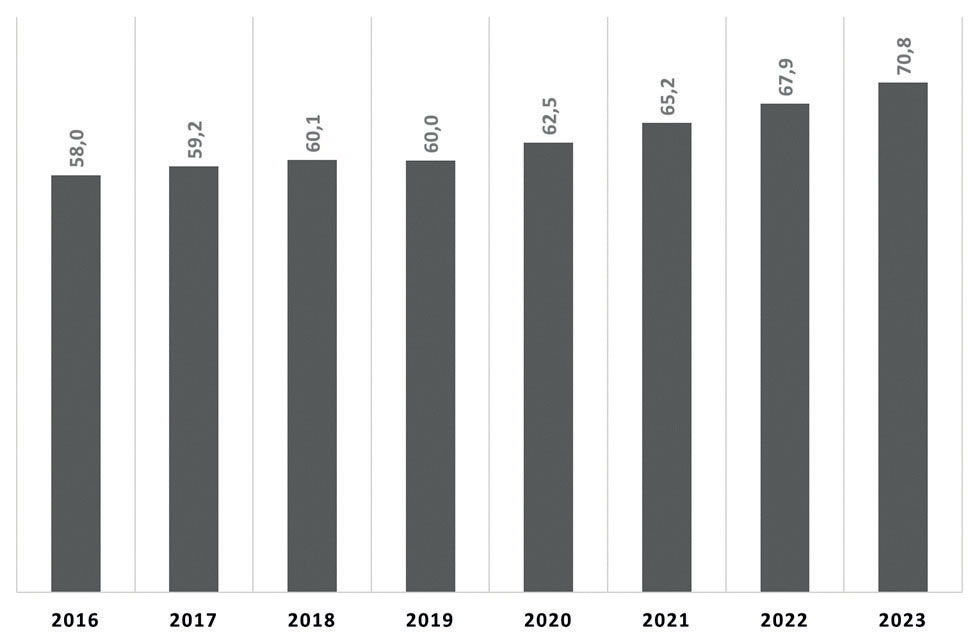

The aluminium industry is essential for the economy of modern countries as it provides a range of highly differentiated products and components used as inputs for a variety of final and capital goods. As an indication of the increasingly strategic role of this industry, over the past few years global demand for primary aluminium has virtually doubled, from 32.6 to 64.2 million tons over the 2005-2019 period, and is estimated to grow further to almost 71 million tons in 2023 (see Figure 1). In 2020, the global turnover of the aluminium industry reached €130 billion with growth expected in the period 2021-2027 at a compound annual rate of over 5%, despite the sharp slowdown imposed by the economic crisis related to the COVID-19 health emergency. The main areas of aluminium use are undoubtedly the transport, construction, packaging, electronics and machinery industries.

The traditional drivers of the expected growth in global aluminium demand are represented by the specific performance characteristics mainly related to lightness, high strength, ductility and electrical and thermal conductivity, but it is important to note that today its increased use is considered to be mainly functional to the progressive improvement of environmental performances.

Aluminium is considered fundamental by many downstream industries for the progress of the environmental performance of their products. For example, in the automotive sector, companies are increasingly favouring aluminium as a substitute for steel in the manufacture of car parts and components (engine and transmission, chassis and suspension, wheels, etc.) with the aim of reducing CO2 emissions over their working life through the reduction of functional weight and assembly and maintenance costs, the improvement of fuel efficiency and of their durability and strength. Aluminium is also considered one of the most environmentally sustainable metals because it can be recycled almost indefinitely. It is estimated that 75% of all aluminium produced globally to date is still in use due to effective recovery and reuse activities. The secondary production of aluminium, through the recovery of processing waste and scrap from products containing aluminium at the end of their life cycle, allows an energy saving of 95% compared to the production of primary aluminium and represents an important element in the broader decarbonisation process which the aluminium industry has been undertaking for years and which has led to a significant reduction in carbon intensity at all stages of the processing of the metal. According to European Aluminium data, the carbon intensity of primary aluminium production in Europe has decreased by 21% compared to 2010 and is equal to 7 kg of CO2 equivalent per kilogram of aluminium. However, there are still strong differences between the different areas considering that the European value is much lower than the global average (18 kgCO2eq/kg) and the average of aluminium production in China (20 kgCO2eq/kg), while the best environmental performances are below 4 kgCO2eq/kg. Similarly, the carbon intensity of European production of aluminium rolled products and aluminium extrusions decreased by 25% and 11% respectively compared to 2010 values. During the same period, the decrease in carbon intensity was 9% in secondary aluminium production.

The evolution of the aluminium industry in the European Union

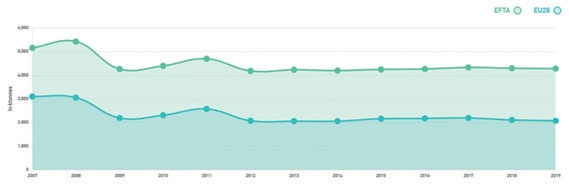

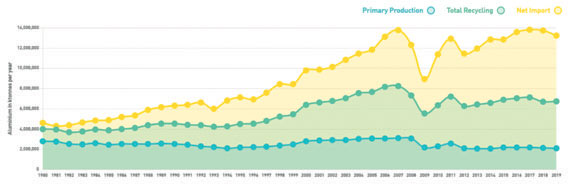

In the period 2007-2019, despite sustained growth in demand, primary aluminium production in the European Union decreased by about 30% (see Figure 2). Additional production cuts and further plant closures are also expected in the coming months. As a consequence, domestic production of primary aluminium covers little more than a quarter of the apparent consumption of the European Union, which therefore remains heavily dependent on foreign imports for about half of its needs. On the other hand, secondary production, although it has represented since the beginning of the 2000s the main mode of production of raw aluminium in the European Union, is not sufficient to cover the part of domestic demand for downstream processing not satisfied by the domestic production of primary aluminium (see Figure 3). On the other hand, in the European Union, which is structurally poor in raw materials, the presence of upstream steps related to bauxite mining, alumina refining and primary aluminium production has historically been very small. The European aluminium industry has progressively specialised in the production of aluminium semis, such as rolled products, extrusions, foundry castings and forged products, which are mainly characterised by the presence of small and medium-sized enterprises, which today account for about 70% of the annual turnover and around 90% of total employment in the EU aluminium industry. The summary picture described above occurred in the presence of a system of import tariffs on raw aluminium (differentiated by type of metal, alloyed and unalloyed, and by formats) which, according to the European Commission, should have supported the domestic production of primary aluminium. A growing number of studies by research centres, academic institutions and stakeholders in Europe, including Ecorys, CEPS, LUISS University and FAIReconomics [1], have highlighted over the last decade the substantial ineffectiveness of this instrument in providing adequate protection to European smelters and how duties imposed on imports of raw aluminium have ended up burdening with an additional cost the companies located downstream in the production chain of aluminium semis which, as previously mentioned, constitutes the core of the EU aluminium industry. The cumulative amount of the extra cost incurred by EU downstream companies has been estimated by GRIF of LUISS University at about €18 billion in the 2000-2017 period, net of the so-called perfecting traffic which allows companies not to pay the tariff when aluminium is temporarily imported to undergo one or more processing operations and to be subsequently re-exported. The presence of the tariff on raw aluminium has therefore imposed on the production chain of aluminium semis and final consumers a surcharge of €60-80 per ton of aluminium used, which corresponds to an average extra procurement cost of €1 billion per year, equivalent to about 4% of the estimated turnover of the entire downstream segment in the EU.

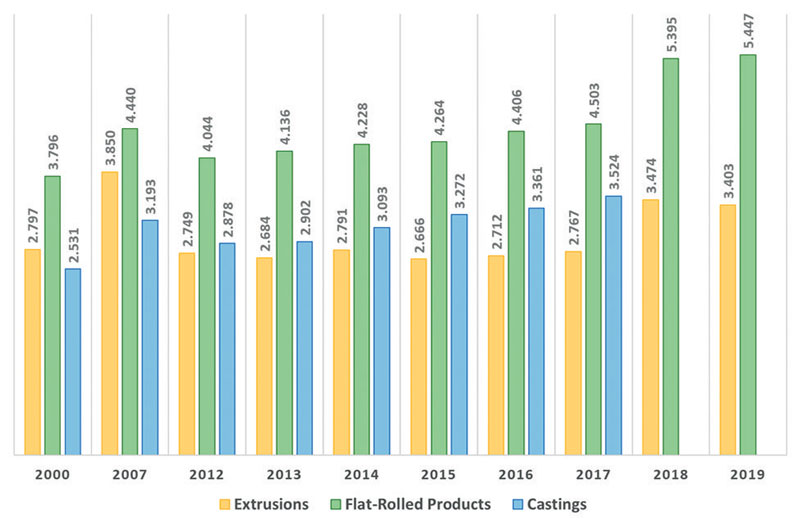

The additional costs have been converted into additional revenues not only for EU producers of raw aluminium (respectively 32% and 26% of the total revenues for secondary aluminium producers and primary aluminium producers), but also for smelters located in countries, such as Norway and Iceland, from which raw aluminium can be imported duty-free due to preferential trade agreements (25% of the total extra revenues). Along the same lines, a recent study on the German aluminium industry by FAIREconomics estimates the additional costs incurred by aluminium processors at around €85/ton for a cumulative total of between €2.9 and €5.3 billion in the 2000-2017 period. As already pointed out by previous researches (see Ecorys and GRIF-LUISS), the study also confirms that the same price conditions are applied in the single market regardless of the origin of the raw aluminium and this circumstance contributes in part to explain that only one third of the German companies interviewed were actually aware of the application of an import tariff on foreign supplies of raw aluminium and of the resulting cost increase for aluminium processors. The increase in raw material purchasing costs caused by the presence of the tariff has in any case imposed a structural adjustment process on the downstream aluminium sector which has partly altered the physiological structure of the market. The aluminium downstream sector is a highly heterogeneous segment, comprising several activities using different production processes and characterised by different dimensions. Besides, these activities are present in the individual territories to different extents depending on historical factors, market demand and technological choices, nurturing a manufacturing network and a system of skills deeply rooted in local communities. Companies operating in the downstream of aluminium are also characterised by different cost structures which may depend as much on different power relationships with suppliers as on differences in environmental conditions linked, for instance, to the costs of labour, energy, etc. The imposition of a uniform EU-wide import tariff has led to the exit from the market of companies characterised by higher costs and/or limited market power in their demand segments, particularly in those markets which are most exposed to increasing international competition. Over the 2000-2017 period, although global demand for aluminium semis has almost quadrupled (from 22.5 to 77.6 million tons), production of rolled aluminium and castings in the European Union has grown at a significantly slower pace than global production, while EU production of aluminium extrusions remained in 2019 below 2007 levels, although global production has trebled since the beginning of the new millennium (see Figure 4). Characterized by relatively higher raw material procurement costs compared to their competitors, aluminium downstream companies are now positioned in technologically advanced productions capable of ensuring margins sufficient for survival or otherwise characterized by high levels of efficiency in processing stages not related to the supply of raw aluminium. The presence of an import tariff on raw aluminium, although it has allowed the consolidation of secondary production which has been able to benefit from artificially higher prices of raw aluminium, has however made other materials relatively more competitive in many end uses, hindering and delaying the diffusion of aluminium products on the market and, among aluminium products, favouring those with a higher carbon footprint. In other words, the artificially higher price of aluminium semis produced in the European Union has pushed many end users to choose alternative materials or aluminium semis manufactured by foreign suppliers at low prices, with a lower, or in any case difficult to verify, environmental performance. In brief, the aluminium supply chain in the European Union has grown over the last twenty years driven by a growing demand mainly related to the traditional drivers represented by the specific characteristics of this material within a regulatory framework and a trade policy whose main objective, however, was not the promotion of an increased use of this metal but rather the protection of primary production. If the objective today is to achieve greater environmental sustainability in line with the targets for the reduction of climate-changing emissions, it is necessary to take note that the approach followed so far leads to an unavoidable contraction of the widespread production network of the downstream sector and has the effect of displacing the domestic production capacity in all those markets of aluminium semis and finished products with low added value which suffer most from international competition from companies not meeting the best environmental standards.

Which policies for the aluminium industry?

The analysis of the past now becomes fundamental to define which industrial policies are necessary to promote the growth and strengthening of the aluminium industry as a tool to increase the environmental sustainability of the European economic system. This is the direction in which the European Green Deal is moving, aiming to transform the European Union into a modern, competitive and resource-efficient economy.

From this point of view, it is first of all necessary to expand the market space for goods characterised by greater environmental sustainability and to make resources available which can be directed towards further improving the environmental performance of production processes and intermediate and final products. In this respect, trade policy plays a very important role, as shown by the start of a review process at EU level, determined not only by the transformed conditions of international trade and by the changes in the strategies of some countries, but also by the need to integrate into trade a logic functional to the achievement of sustainable development and climate change objectives [2]. With reference to the aluminium industry, this means first of all supporting the production and distribution of aluminium products with a low carbon footprint, changing their relative convenience also in terms of price and creating the conditions for investments in research and development of more and more environmentally friendly solutions. As pointed out in the previous paragraph, the preservation of tariffs on imports of raw aluminium is undoubtedly an obstacle to this process, contributing to generate results opposite to those desired in environmental terms. On the contrary, their total abolition would allow downstream industries to recover a competitive margin which would be instrumental in widening the aluminium market space in end uses, as well as to support the growing competition at international level, today undoubtedly hampered by the lack of an effective level playing field among competing producers. Actually, global competition in the downstream sectors is expected to grow in the coming years also due to the significant excess of primary aluminium production capacity which characterises some areas of the planet, especially China, and which represents, as highlighted in a recent OECD study and before that by the US Department of Commerce [3], the result of policies deliberately aimed at supporting the birth and growth of downstream aluminium transformation activities in the territory with the aim of generating income and employment through the satisfaction of domestic demand and, in the future, exports of products with higher added value. Concerns related to the possible negative impacts of the abolition of the tariffs on primary and secondary aluminium production should be addressed by specific measures taking into account the structural characteristics of the different activities and their relevance to the objectives of environmental sustainability and energy efficiency. In primary production, a residual survival space guaranteed through direct and transparent support should be placed in the context of a broader European industrial and commercial policy on raw materials, and would be justified by explicitly recognising its strategic value, which may be primarily attributed to the opportunity of developing technologies with the lowest possible environmental impact and of not being totally dependent on imports. This strategy must promote the environmental sustainability of aluminium by favouring, in the redefinition of trade policies, primary production with low carbon intensity, in order to encourage the adoption and diffusion of the best technological standards and contrast competition from countries deviating from these standards.

In secondary production, it is necessary to adopt specific policies aimed at improving scrap production, transformation, processing, sorting and recovery technologies, in perspective also through a coherent design of final products in partnership with companies in the main user industries (automotive, construction, packaging, etc.), defining appropriate incentives for recycling and reuse at local level. The decision to support the domestic production of primary metal and to strengthen secondary production with the aim of implementing the circularity of the supply chain in the European Union therefore requires instruments other than tariff barriers, whose application has proved to be ineffective and whose preservation risks hindering a greater diffusion of aluminium products functional to the achievement of the European objectives of reducing climate-changing emissions, supporting small and medium-sized enterprises and preventing the manufacturing decline of many territories. In this sense, the economic crisis imposed by the health emergency may represent, also for the aluminium sector, an opportunity to start a path of reform of the European industry and to relaunch income and employment opportunities in many territories.