Foundries and the Aluminium System in Slovenia

The young Slovenian Foundry and aluminium industry is booming. This is explained by Mirjam Jan-Blažić, President of the Slovenian Foundrymen Society, which also this year organized the traditional International Foundry Conference and Exhibition in Portorož

We met Mirjam Jan-Blažić, President of the Slovenian Foundrymen Society, an experienced and dynamic association that has matured very quickly over the last few years, both in terms of quantity and in terms of technical content of the segment represented. We asked President Mirjam Jan-Blažić to provide us with an overview of the cast foundry industry in Slovenia, with a particular focus on the system of aluminium and its alloys. The precise analysis that has been provided to us shows an industrial system with clear ideas, good roots, prepared and ready for international competition.

When was the Slovenian Foundrymen Society founded? What is the current mission and future goals of your association?

The Slovenian Foundrymen Society was founded in 1953 on the initiative of the management of the Faculty of Mining and Metallurgy and the Institute of Metallurgy in Ljubljana. The Society was founded with the objective of bringing together all professionals in the field of foundry and foundry companies in Slovenia, as well as the sub suppliers of foundries that produced raw materials, foundry auxiliaries, refractory materials and foundry equipment. The key mission of the Association is to provide the continuous education to professional cadres in Slovenian foundries, to supplement the foundry records, the library of international foundry journals and the professional literature reading room.

Can you tell us a bit about its history and developments in the early years leading up to the present time? What about the communication of your activity?

From the very beginning following its foundation, the association was required to help the domestic foundries to bridge the technological gap with the developed industrialized countries. At the time of the establishment of the Slovenian Foundrymen Society, the majority of the necessary expertise in the foundry industry was kept at the Department of Montanistics at the University of Ljubljana. Even then, the University staff collaborated closely with European universities and institutes as well as with related foundry companies and associations, e.g. the German Foundry Association and the Technical College in Aachen. The long-standing cooperation with the Institute of Foundry Engineering in Leoben (today’s Oesterreichisches Giesserei-Institut Leoben) and with the foundry associations of Czechoslovakia and Poland also began. 60 years ago, the idea of organising an annual International Foundry Conference (IFC) together with a foundry exhibition was also born, and the event has been held each year since 1963 in the seaside town Portorož. Today, the annual Portorož Foundry Conference and Exhibition is one of the most recognisable foundry events in Europe, and in 2019 the World Foundry Organisation (WFO) has entrusted the organisation of the WFO-Technical Forum to the Slovenian Foundrymen Society. No doubt that the Portorož conference is a great opportunity to Slovenian foundries and sub suppliers of the foundry industry to present their achievements to the domestic as well as foreign professional public. As to the communication, the foundry magazine Livarski Vestnik, which has been published for 67 years, has played a particularly important role in the 60-year tradition of the Portorož International Foundry Conference and the Slovenian Foundrymen Society. It has published the vast majority of scientific and technical papers from the Portorož conference to date. Since 2001, these contributions have also been available bilingually, both in Slovenian and English.

What can you tell us about your associates both in terms of consistency and technical characteristics?

Today, our association is one of the oldest and largest technical bodies in Slovenia in the post-World War II era. It is made up of all large and medium-sized foundries in Slovenia as well as some smaller foundries and sub suppliers to the foundry industry (a total of all legal entities is 35 with just over 300 members who are natural persons). Since its establishment, the association’s key mission has been broadened with new content, disseminating scientific and technological developments in modern foundry technology, providing for the improvement of the professional knowledge of its members.

Concerning the use of aluminium in Slovenia, what is the total primary and recycled aluminium used, what is the internal production and use of rolled products, extrusions, foundry castings, and the final destination of the total amount of aluminium used in Slovenia in the different sectors of application?

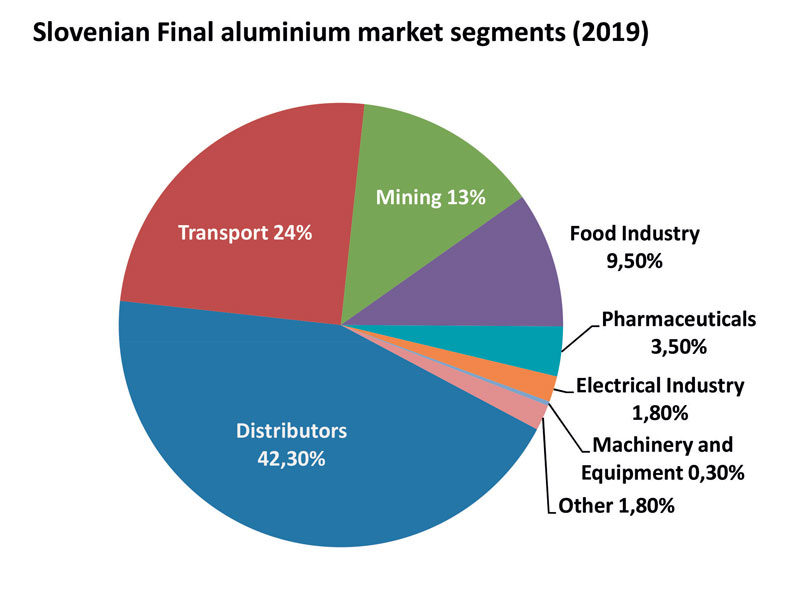

Slovenia is a small country today with a population of just over 2 million. At the same time, our country is still relatively young, as this year was only the 30th anniversary of Slovenian’s independence, but over these three decades, we have managed to increase the gross domestic product per capita, which is now four times higher than at the moment of independence, i.e. €22,014 in 2020, and our production aluminium industry, together with the aluminium processing industry, has contributed to these achievements. Immediately after the Second World War and with the support of the former Yugoslavia, the production and processing of aluminium began to grow and develop in the territory of Slovenia in the newly established alumina and aluminium production company, TGA Kidričevo (today evolved into Talum d.d.). Simultaneously, the growing demand for aluminium products led to the beginning of aluminium processing at Impol d.o.o. Slovenska Bistrica, which until that moment had been exclusively engaged in copper processing. Over the last 65 years, these two companies have grown to become the largest producers and processors of aluminium in Slovenia. Until 1981, company TGA (today Talum d.d.) was the exclusive producer of primary aluminium, afterwards, the company has gradually expanded its product range into various areas of aluminium processing. The company’s published statistics show that its total goods production of Al products in 2020 (the first year of the pandemic) equalled 117,090 tonnes. Of this total, 50,185 tonnes are attributable to the primary production (approx. 50% of capacity) and 37,053 tonnes to round blanks. Impol d.o.o., headquartered in Slovenska Bistrica, is the largest aluminium processor in Slovenia. According to accessible company statistics, the company reached 242,500 tonnes of Al semis production in 2019, while in 2020, the number was reduced to 223,697 tonnes due to the pandemic. In 2019, the structure of Al products was as follows: 35.7% strips and sheets, 4.1% colour strips, 6.2% round blanks, 19.7% foils and thin strips, 1.7% pipes, 25.7% rods and hard drawing billets, 6.3% profiles, 0.1% finished products.

What is the total amount of foundry castings produced in Slovenia? Can you subdivide this amount by production technology and final destination of the castings?

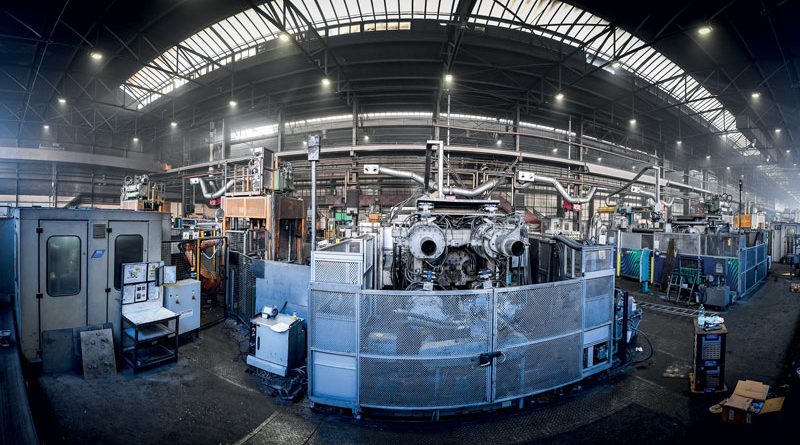

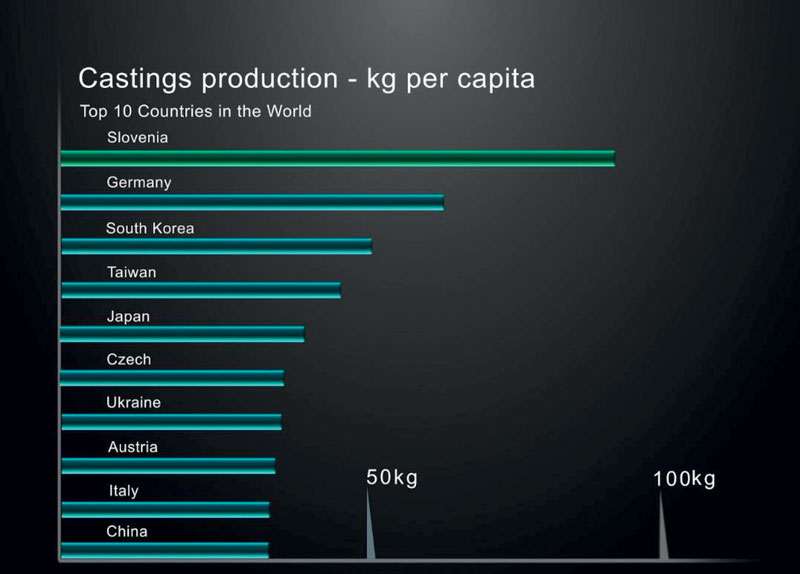

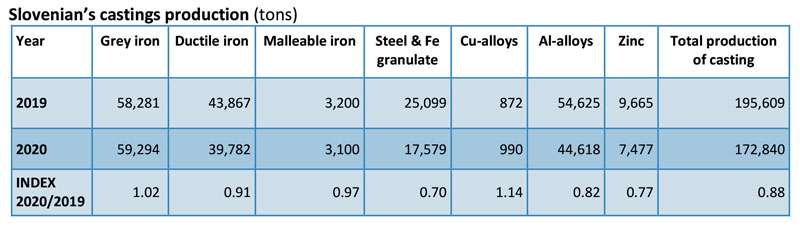

Slovenian foundry represents an important part of Slovenian industry. Namely, Slovenia is a strong foundry country, which, despite the small size of the country, has a wide range of foundry technologies, which usually does not apply to small countries. Slovenia has about 70 foundries with just over 5,000 employees. Small and medium-sized foundries account for approximately 90% of all foundries revenues. In Slovenia, the longest tradition lasting more than 220 years is in the casting of cast iron. Over the last three decades, however, the casting of non-ferrous, especially Al alloys, has been growing rapidly and strongly. The table 1 shows the production volume of Slovenian foundries by type of castings in 2020 compared to 2019. The production figures are presented as follows: the total production of Slovenian foundries in 2020 amounted to 172,840 tonnes and in 2019 195,609 tonnes. So in 2020, there was a 12% reduction compared to 2019. Grey iron production was 1% higher than in 2019 (59,294 tonnes). The production of ductile iron was 397,782 tonnes, which is only 91% of the 2019 total. Steel and Fe granulate were produced in 17,579 tonnes, which is only 70% of the 2019 total. The production of non-ferrous metal castings in 2020 amounted to 53,085 tonnes, which is only 81% of the 2019 total. The foundry production is facing all the problems as the entire European production (energy prices, transport problems, raw material prices etc.). It must be said that the Slovenian situation is somewhat special: the export of castings to, say, Germany, Austria, Italy etc., is more than 85% of the total production. If we compare our foundry production in kg per capita with other countries around the world, Slovenia is well ahead of the rest or even at the very top of the list (Figure 1). Some of our largest foundries in the field of Al-alloy die-casting are among the world leaders in terms of the level of the achieved technological development. Their success is based on high quality and modern machinery, investments in development and professional cadre. The well-developed toolmaking industry in Slovenia is also particularly important and deserves special credit in connection to the high quality of foundry products realized. The vast majority of our largest aluminium foundries have their own large tool rooms and are the direct or indirect suppliers of complex components to the automotive and engine industry. Today, our Al alloy foundries supply components and assemblies for petrol and diesel engines, gearboxes, brake and drivetrain parts, control systems and electronic components as well as parts for hybrid and electric vehicles.

What are the future prospects in the use of aluminium in the different sectors in your country?

Given the size of Slovenia and its economy and market opportunities, it is difficult for us to predict any significant shifts. A maximum of 5% annual growth can probably be expected . The Aluminium production and processing industry today exports more than 80% of their total production. We believe that no significant changes within the Slovenian market are to be expected in the future in terms of the need for significant consumption of primary and secondary aluminium in the future. Until now, the Slovenian state or all its governments has supported the production of primary electrolytic aluminium and its processing domestically. Aluminium is a strategic raw material and a metal of the future, indispensable in today’s life, and we believe that it will remain important even in the future. Foundries that are suppliers to the automotive industry have already gone through, and will continue to undergo, more intensive restructuring in recent years as a result of the phasing out of petrol and diesel cars and the transition to electric and hybrid cars. Regardless, aluminium-based alloys will continue to be the most important raw material. It is difficult to predict or estimate what the future consumption of Al alloys in the foundry industry will be in terms of volumes compared to the current situation.

What do you think about the Metef Expo in Italy?

A couple of years ago, we assessed that the Metef exhibition had the ambition and the potential to develop and become a smaller version of GIFA. However, the unfavourable global changes brought about by the coronavirus pandemic last spring have apparently influenced the organisers of the exhibition to focus primarily on Customized Technology for Aluminium & Innovative Metals Industry, while specifically targeting the areas of: Industrial Engineering, Automotive Industry, Energy & Materials and Security & Defence. Given that you have a well-developed aluminium production and processing sector in Italy, such an event would also attract more interest from your local companies in participation and exhibiting at this international event, which will be of interest to those of us coming from other countries. We recommend to our companies in the Al sector, and in particular Al alloy foundries as well as the sub suppliers for this portion of the foundry industry, to participate in the next year’s Metef exhibition in Bologna between 9 and 11 June 2022 as exhibitors or at least as visitors.

What is the position of your association about the EU’s Carbon Border Adjustment Mechanism CBAM?

We find the European Commission’s announced plans to include aluminium in the pilot phase of the EU’s Carbon Border Adjustment Mechanism (CBAM) unacceptable. At the level of the Chamber of Commerce and Industry of Slovenia, we have formulated the following positions and proposals in this regard. We believe that aluminium production should not be part of the proposed action, particularly in the first period between 2021 and 2025. The main objective of CBAM should be to eliminate carbon leakage and reduce global emissions, the proposed mechanism for aluminium production is unlikely to yield these results. This is due to the aluminium sector’s high exposure to indirect costs of carbon emissions. We believe that the CBAM will be detrimental to both EU aluminium producers and their customers, i.e. to the economy and society as a whole. If CBAM does not cover the entire aluminium value chain from primary to final consumer product, the downstream portion of the value chain will be strongly encouraged to move out of Europe while on the other hand, our global competitors such as China will still be able to export carbon-intensive products to Europe and avoid border taxes. Taking all of these challenges into account, we believe that despite certain shortcomings, offsetting the indirect costs of the ETS and the free allocation of emission allowances (EUA) is the optimal way to protect our energy-intensive industry from carbon leakage in the EU ETS phase 4 period. In our opinion, to make CBAM work as intended, it must verifiably determine the precise impact of emissions from electricity generation on electricity prices for all aluminium importing countries. It must at the same time prohibit avoidance by mixing sources, and it must encourage our global competitors to reduce emissions. The energy-intensive industry requires a stable regulatory framework to plan investments that are long-term in nature and at risk due to the constantly evolving regulatory environment. This will be even more important in the next decade given the EU’s increased climate ambitions and the scale of technological innovation required to decarbonise industrial processes. The existing carbon leakage measures have protected our industry to a certain extent and should be improved even further rather, instead of creating an entirely new system that increases the risks to its operation due to its complexity and the apparent potential for duty avoidance.